What Is Social Security Tax Rate For 2024

What Is Social Security Tax Rate For 2024. What retirees must know before 2024. We call this annual limit the contribution and benefit base.

This rate is divided into two parts: Social security benefits can be taxed at.

What Retirees Must Know Before 2024.

Paying taxes on social security benefits:

(Thus, The Most An Individual Employee Can Pay This.

Social security benefits can be taxed at.

The State Income Tax On Social Security Benefits Would Be Eliminated Starting In The 2024 Tax Year Rather Than Phased Out Over Four Years Per The Original House Bill.

Images References :

Source: atonce.com

Source: atonce.com

Maximize Your Paycheck Understanding FICA Tax in 2024, Each year, a wage cap is set that determines how much income gets taxed to fund social security. As your total income goes up, you’ll pay federal income tax on a portion of the benefits while the rest of your.

Source: what-benefits.com

Source: what-benefits.com

Are My Social Security Benefits Taxable Calculator, Catch the top stories of the day on anc’s ‘top story’ (27 march 2024) Social security taxes in 2024 are 6.2 percent of gross wages up to $168,600.

Source: medicare-faqs.com

Source: medicare-faqs.com

When Is Medicare Disability Taxable, Those exceeding those thresholds will pay tax on no more than 25% of social security income. Will you pay taxes on your benefit in 2024?

Source: learn.financestrategists.com

Source: learn.financestrategists.com

Social Security Tax Definition, How It Works, Exemptions, and Tax Limits, The social security wage base limit is $168,600.the medicare tax rate is 1.45% each for the. (thus, the most an individual employee can pay this.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Paying Social Security Taxes on Earnings After Full Retirement Age, For 2024, an employer must withhold: That’s what you will pay if you earn $168,600 or more.

Source: www.loftuswealthstrategies.com

Source: www.loftuswealthstrategies.com

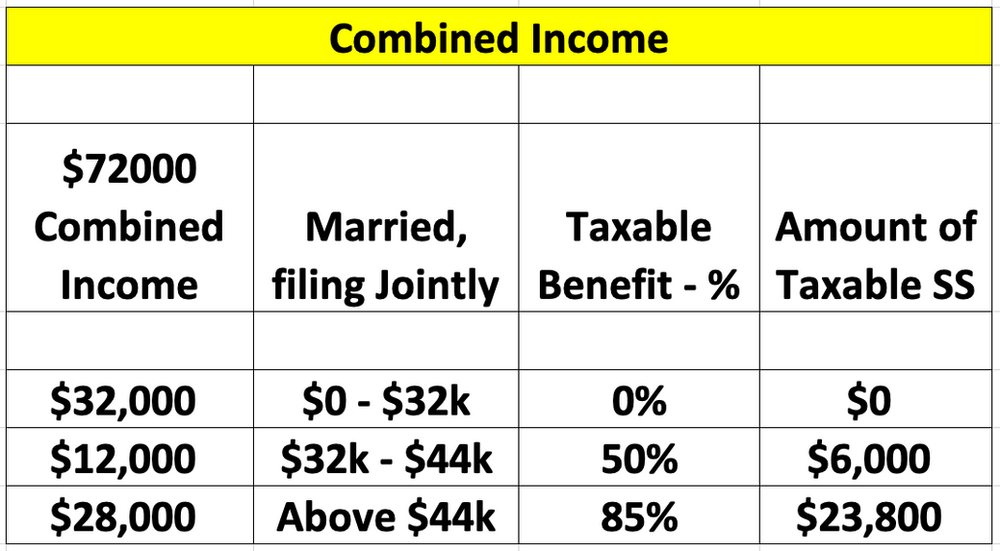

What Is The Taxable Amount On Your Social Security Benefits?, • 3mo • 5 min read. The limit for 2023 and 2024 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

Source: www.usatoday.com

Source: www.usatoday.com

Do this during tax season to maximize your Social Security benefits, Office of the chief actuary. This rate is divided into two parts:

Source: www.usatoday.com

Source: www.usatoday.com

Social Security benefit taxes by state 13 states might tax benefits, In 2024, the wage cap is $168,600, up from $160,200 in 2023. If you work for an employer, you are.

Source: www.youtube.com

Source: www.youtube.com

How To Calculate, Find Social Security Tax Withholding Social, The social security tax rate is 12.4 percent in total where you and your employer pay 6.2 percent each. Given these factors, the maximum amount an employee and employer would have to pay.

Source: hasgr.com

Source: hasgr.com

Social Security 2022 Benefits Heintzelman Accounting Services, Up to 50% of your social security benefits are taxable if: Tax rates for each social security trust fund.

The Social Security Limit Is $168,600 For 2024, Meaning Any Income You Make Over $168,600 Will Not Be Subject To Social Security Tax.

This rate is divided into two parts:

You File A Federal Tax Return As An Individual And Your Combined Income Is Between $25,000 And $34,000.

Each year, a wage cap is set that determines how much income gets taxed to fund social security.